Car Accident Without Any Other Car Insurance Goes Up

Getting into a car accident in which you are at fault can raise your auto insurance rates in a big way. On average, the annual cost for a full-coverage car insurance policy goes up 46% if the driver has an accident on their record that caused an injury. How much rates go up depends on a range of factors.

Many car insurance companies offer accident forgiveness or safe-driving programs, which either waive rate increases or reward you for being accident-free. Those can prevent auto insurance rates from going up — or at least keep prices down.

Comparing rates from multiple insurers, even after an accident, is still among the best ways to save money on car insurance.

- How much will your car insurance rates increase after an accident?

- Which companies offer the best rates after an accident?

- How long does a car accident stay on my insurance?

- What insurers might not consider a car accident

- How to limit insurance rate increases after an accident

- Frequently asked questions

How much will your car insurance rates increase after an accident?

If you get into an accident in which you are at fault and someone is injured, your car insurance rates could go up $1,157 on average, an increase of 46%.

That rate hike was most pronounced in Michigan, where that sort of accident more than doubled annual costs. In contrast, an accident in Kansas only raised rates 8%.

| State | Annual policy cost | With accident | Difference |

|---|---|---|---|

| Michigan | $6,882 | $14,131 | 105% |

| New Jersey | $2,387 | $4,539 | 90% |

| California | $1,932 | $3,550 | 84% |

| Louisiana | $3,082 | $5,226 | 70% |

| Texas | $2,497 | $4,194 | 68% |

| North Carolina | $1,379 | $2,309 | 67% |

| Florida | $2,751 | $4,549 | 65% |

| Illinois | $2,049 | $3,340 | 63% |

| Indiana | $1,441 | $2,339 | 62% |

| Georgia | $2,204 | $3,528 | 60% |

| Arizona | $2,753 | $4,401 | 60% |

| Nevada | $2,986 | $4,744 | 59% |

Show All Rows

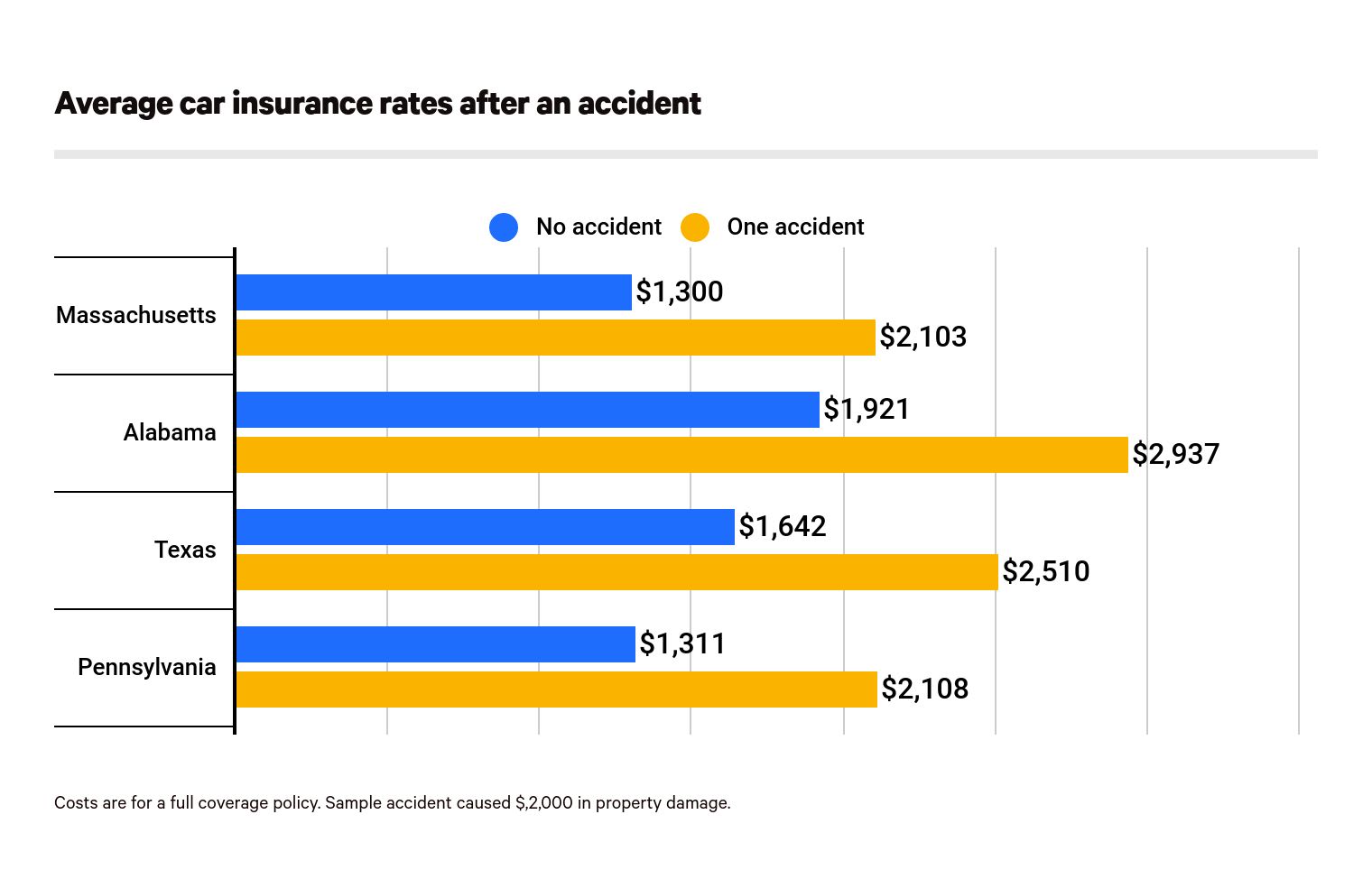

Rates increase even more when an accident involves property damage of $2,000 or more. Car insurance premiums increased 56% with that sort of accident on a driving record, based on a four-state study. Rates only increased 47% in those four states with an accident where a bodily injury claim was made.

Find Cheap Auto Insurance Quotes After an Accident

It is important to note that if you are not found at fault for an accident, your insurance rates will likely not go up. But that's not true in all cases, as some companies raise rates slightly after that sort of incident.

After an accident, your state's laws and your insurer heavily influence the impact to your rates. That's why we always urge consumers to compare quotes. The same driver seeking insurance after an accident might be treated very differently among various insurers.

Which companies offer the best insurance rates after an accident?

After an accident, your insurer will have an impact on how much your rates go up. Different insurers boast different offerings when it comes to how they treat accidents.

Many companies offer some level of "accident forgiveness ", meaning they allow for the first accident to be ignored in terms of raising rates. Usually, accident forgiveness is either an add-on that costs more or a perk offered after multiple years — often five or more — with a clean driving record. For example, State Farm's accident forgiveness goes into effect after nine years without an accident.

Across five of the largest insurers, State Farm had the smallest rate increase, 24%, after an accident that led to a bodily injury claim. Allstate, Progressive and Geico rates for full-coverage auto insurance went up at least 50% on average.

| Company | Annual policy cost | With accident | Increase |

|---|---|---|---|

| State Farm | $1,623 | $2,020 | 24% |

| USAA | $1,288 | $1,824 | 42% |

| Allstate | $3,585 | $5,488 | 53% |

| Progressive | $2,321 | $3,569 | 54% |

| Geico | $2,017 | $3,194 | 58% |

Insurers also put certain thresholds on what is considered an accident when it comes to raising rates. For example, in order to say an accident occured, State Farm requires a claim to be over $750 between liability and collision coverages. In addition, the driver needs to be at least 50% at fault. Geico is similar, with a $500 threshold in most cases.

How long does a car accident stay on my insurance?

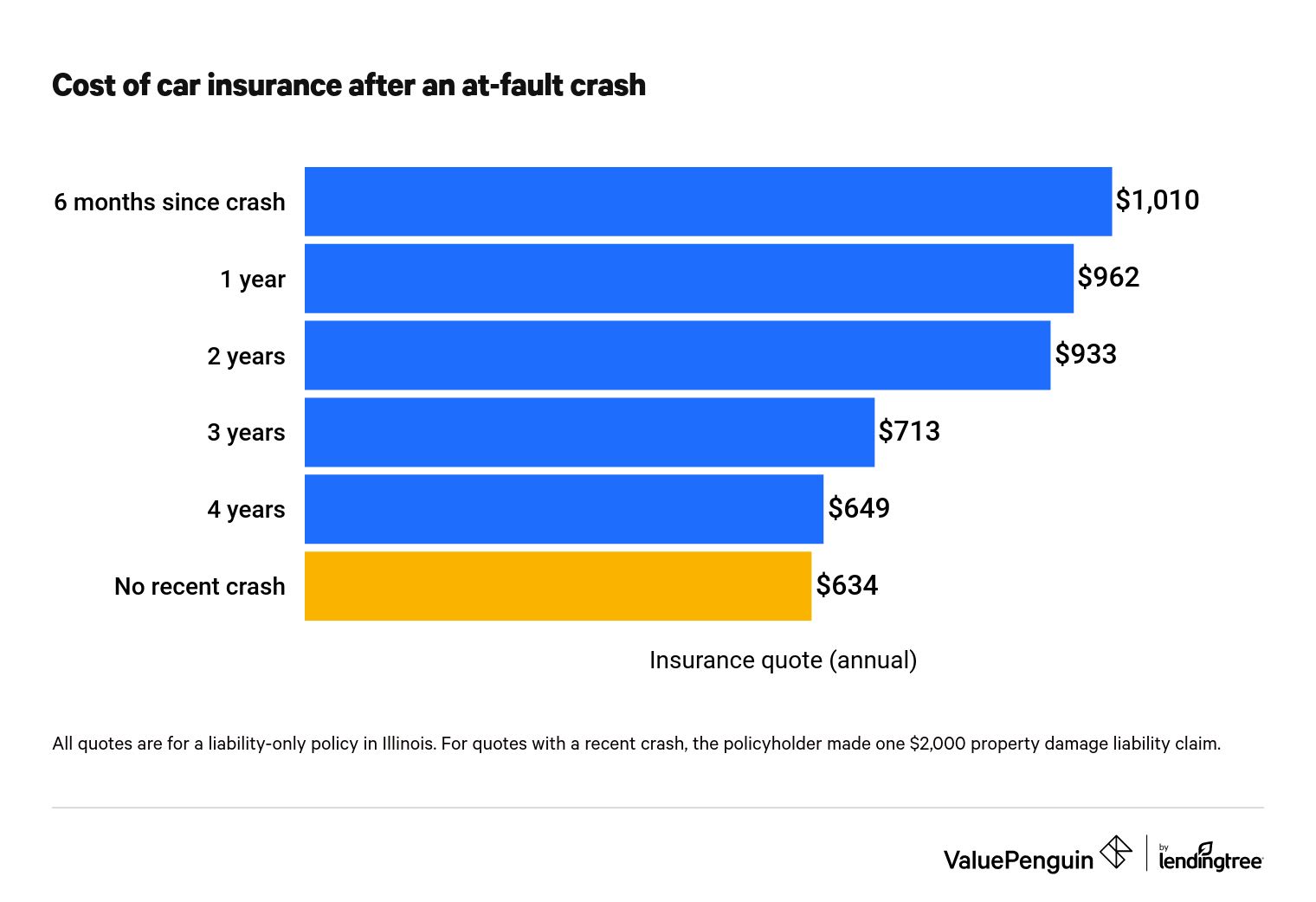

The longer ago you made a claim on your insurance, the less of an impact it will have on your rates. Your rates will go up the most immediately after the crash, then return to normal after between three and five years.

In our research, we found that if you were responsible for a crash within the last six months and made a liability claim as a result, your rates will increase by about 60% the next time your policy renews. That increase will go away gradually over time, with rates lowering to about 47% higher than normal after two years and only 2.4% higher than normal after four years.

| Time since at-fault crash | Annual cost of insurance | Percentage increase from no accident |

|---|---|---|

| 6 months | $1,010 | 59.4% |

| 1 year | $962 | 51.8% |

| 2 years | $933 | 47.3% |

| 3 years | $713 | 12.6% |

| 4 years | $649 | 2.4% |

| No recent crash | $634 | — |

Prices are 12-month quotes for minimum coverage in Illinois. Policyholder made an at-fault property damage liability claim of $2,000.

Car insurers have found that drivers who have been responsible for a crash recently (and made a liability claim on their insurance) are more likely to make another claim; as a result, insurers charge these drivers more. However, the longer ago that incident was, the less it will affect your insurance rates.

When an accident might not increase car insurance rates

Defining what isn't an accident is more complicated than defining what is. But most insurance companies consider the driver's fault in an accident.

Some insurers check whether the policyholder is at least 50% at fault. If you don't meet this threshold, then your insurer often won't increase your rates. But there are exceptions. For example, some insurers don't follow this rule for new customers. But proving fault in an accident can be difficult.

According to State Farm, the policyholder isn't at fault if they were:

- Lawfully parked.

- Reimbursed by, or on behalf of, a person responsible for the accident.

- Rear-ended and not convicted of a moving traffic violation in connection with the accident.

- Hit by a hit-and-run driver, as long as the accident is reported to the proper authorities within 24 hours.

- Not convicted of a moving traffic violation in connection with the accident, but the other driver is.

- Reporting damage caused by birds, animals, missiles or falling objects.

Generally, insurance companies focus on the three years prior to your policy start date. So if you were involved in an accident five years ago, it generally won't be considered when calculating your rates. But this time frame may not apply to some accident-forgiveness programs.

How to limit insurance rates from going up after an accident

If you are at fault in an accident and are unable to get accident forgiveness, there are other ways to hold down the costs of car insurance premiums. Your rates are calculated based on a range of factors, and you can do a few things to improve your profile.

- Add discounts: Insurers offer a wide range of discounts, including discounts for good students, for having multiple policies and for good driving tracked by an app. Check with your insurance company for your options.

- Raise your deductible: There is risk inherent in this approach because it means more out-of-pocket expenses if you are at fault in another accident. However, a higher deductible will lower your premium.

- Reduce your coverage: Although not an ideal choice, getting less coverage is a way to reduce your rates. You will still need to have the minimum coverage mandated in your state.

- Improve your credit score: Not all states factor in credit scores for insurance costs, but many do. Paying off debts, not missing payments and addressing any issues on your credit report can all help lower rates.

- Shop around: When in doubt, there's always value in seeing who is offering the best rates for you. Different insurers might treat your situation differently, so seeing the options is always advisable.

Frequently Asked Questions

How much does insurance go up after an accident?

Car insurance premiums increase an average of 46% after an accident with a bodily injury claim, according to an analysis of national rate data. Accidents with extensive property damage — $2,000 or more — can raise rates even more than that.

Can you get insurance after an accident?

In the vast majority of cases, yes. You will likely have to pay more, unless your company offers accident forgiveness and you qualify.

Will my insurance go up if I file a claim?

If your claim is just above or below your deductible, it usually makes sense to pay out of pocket to avoid any surcharges or potential increases in rates. Some policies require you to report any accidents to your insurer. How much insurance rates go up after a claim may vary based on your driving record and the severity of the accident.

How long does an accident affect your insurance?

Insurers most often focus on the past three years of your driving record when setting rates. An accident usually affects rates for at least that long, though some insurers factor in an at-fault accident for up to five years or longer in rare cases.

Do insurance rates go up after a no-fault accident?

In most situations, your rate will not go up after an accident in which you are not at fault. However, some companies may raise your rates even if you're not the at-fault party.

Methodology

Rates for accidents with bodily injuries were based on rates gathered from every state. Rates for accidents with property damage were based on drivers in Pennsylvania, Massachusetts, Texas and Alabama. A 30-year-old man with a 2015 Honda Civic was used as a sample driver. The driver had a clean driving record outside the specified infractions.

The coverage limits were set as follows:

| Coverage type | Limits |

|---|---|

| Bodily injury liability | $50,000 per person/$100,000 per accident |

| Property damage liability | $25,000 per accident |

| Uninsured/underinsured motorist bodily injury | $50,000 per person/$100,000 per accident |

| Comprehensive and collision | $500 deductible |

We used Quadrant Information Services to compile the analysis and insurance rate data. The data is publicly sourced from insurer filings. Rates should be used for comparative purposes only, as your quote may be different.

Car Accident Without Any Other Car Insurance Goes Up

Source: https://www.valuepenguin.com/how-does-accident-affect-my-car-insurance-rates